Farmland Market: Are We Up, Down, or Sideways?

October 10, 2018

Land values are always a hot topic of discussion and one that creates a lot of speculation. I have never seen a time in which I have read so many conflicting reports about what is happening with the market. Through the internet, social media, and other sources, we are inundated with articles and news about the market. I recently read an article that talked about the extreme strength in the market and that we are actually higher, whereas in other areas we are lower to significantly lower. Ironically, one could almost say this is true within a given county. If there is one word to accurately describe today’s land market, it is “erratic.”

Land values are always a hot topic of discussion and one that creates a lot of speculation. I have never seen a time in which I have read so many conflicting reports about what is happening with the market. Through the internet, social media, and other sources, we are inundated with articles and news about the market. I recently read an article that talked about the extreme strength in the market and that we are actually higher, whereas in other areas we are lower to significantly lower. Ironically, one could almost say this is true within a given county. If there is one word to accurately describe today’s land market, it is “erratic.”

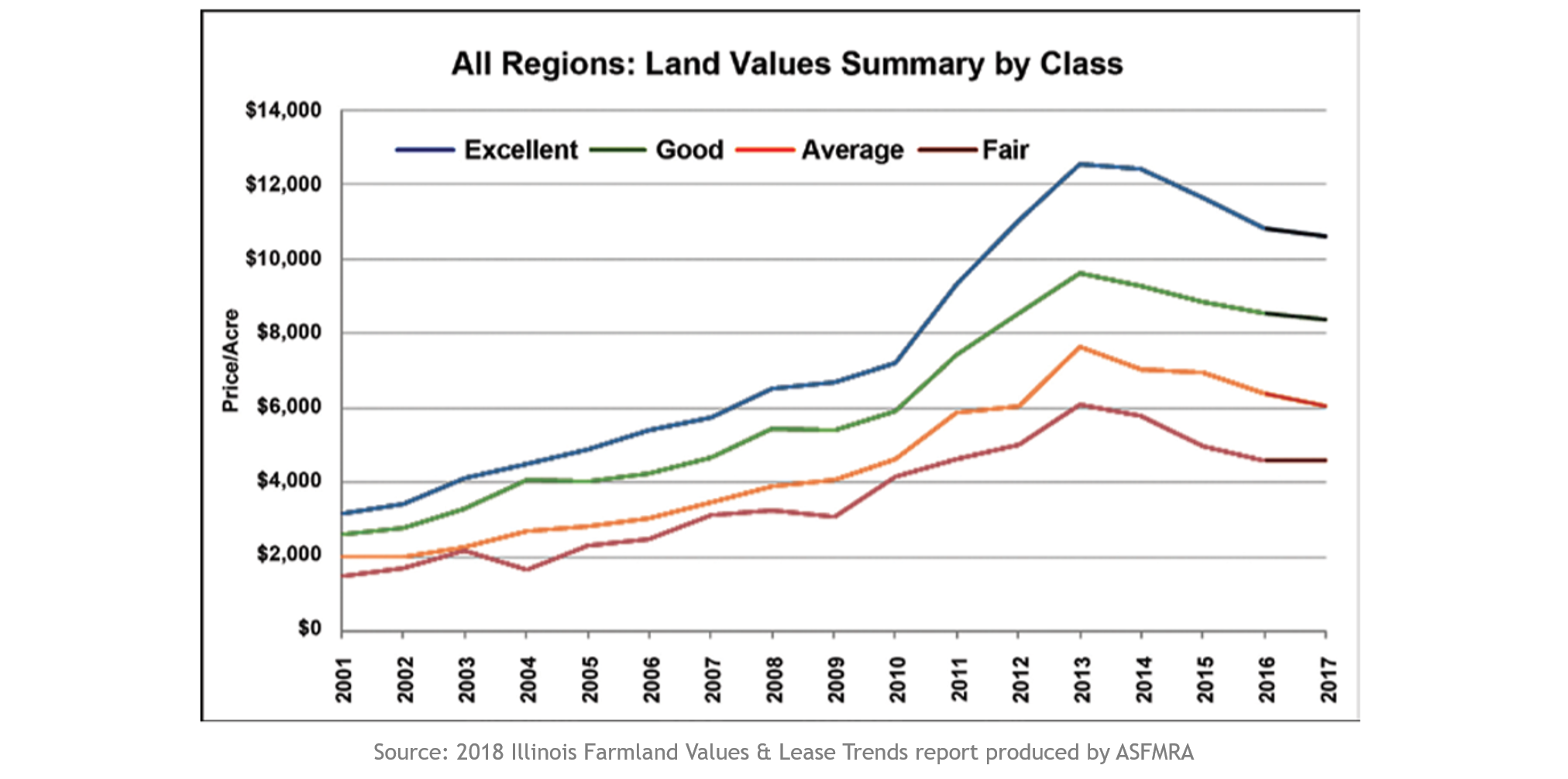

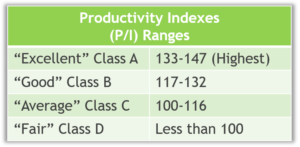

The Illinois Society of Farm Managers and Rural Appraisers (ISPFMRA) conducts a comprehensive yearly survey of the entire state of Illinois that is based on actual data from land transactions. Our part of the state is known as Region 7, or the West-Central Region. Please bear in mind that our region covers 10 counties, which is a significant area. At the end of 2017, the survey conducted within our region indicated that values for “excellent” land were selling in a range from $10,250 per acre to $12,000 per acre. The “good” land was selling from $6,250 per acre to $9,000 per acre. Both of these indicated a decrease of 2% to 5% in calendar year 2017. The “average” soils sold at a very wide range from $3,500 per acre to $5,750 per acre, which was down 5% to 7%. Recreational land was down 5% to 10%.

ISPFMRA also conducts a mid-year survey, which was completed on June 30, 2018. The survey responders indicated that farmland dropped an additional 2% to 3% during the first six months of 2018. It is important to note that the most significant sell-off in the commodity markets happened after this survey was completed. The survey also indicated that 60% of the responders expected farmland to decrease another 1% to 5% during the last half of 2018.

Obviously, the bias is a bit on the defensive side. In our area, we are still seeing very good demand for high-quality Class A soils. The range in sale prices is more significant in the lesser-quality Class B, C and D farms. As is always the case, location, location, location is vitally important, and probably more so than ever. In certain areas where there is strong demand from progressive and accomplished farmers or land lords who are seeking additional land, the market seems to have been affected very little, while in other areas it has taken a noted drop.

I recently read an informative article about two farm sales in Iowa. Both sales took place the same day in the same county, one on the West side and the other on the East side. Both tracts were similar in size, had similar amounts of tillable acreage, and very similar Productivity Indexes. On paper, they had many similarities; however, on that given day, one of the farms sold for $11,000 per acre and the other for $7,700 per acre. They were only 16 miles apart.

What would account for such variability? There were two factors that played a significant role in this sale. While they had similar Productivity Indexes and similar percentages of tillable acreage, one farm had a ditch running through it and the tillable acreage was divided into three or four fields. In other words, the “farmability” was much poorer. As today’s farm machinery has increased in size, the importance of farming convenience and efficiency plays a greater role than ever. In this particular case, the higher value sale also had two strongly competing land buyers who drove the market.

In the prime of 2012/2013/2014, it seemed all land sold well. At that time, we had “The Big Three” – strong commodity prices, low interest rates, and scarcity of supply. We have lost the strong commodity prices and interest rates are feeling some upward pressure.

By no means am I bearish about the market, but buyers are cautious which is lending itself to a slower-developing market than usual. In my opinion, land is always a good investment, and when look at its long-term return, nothing beats it.

Author: Allan Worrell – State Certified General Real Estate Appraiser, Accredited Land Consultant, Accredited Farm Manager, Land Broker